We have changed the way you can Join and Apply for Loans.

Whether you’re already a member or not, click here to apply:

Members, remember to have your membership number to hand.

New joiners will require ID, proof address and National Insurance Number

We have changed the way you can Join and Apply for Loans.

Whether you’re already a member or not, click here to apply:

Members, remember to have your membership number to hand.

New joiners will require ID, proof address and National Insurance Number

Covid-19 Guidelines

Covid-19 restrictions have now been relaxed, Covid is still with us, but declining in our region. If you haven’t yet been vaccinated, or received your 6-month booster, you can book this online on the NHS website.

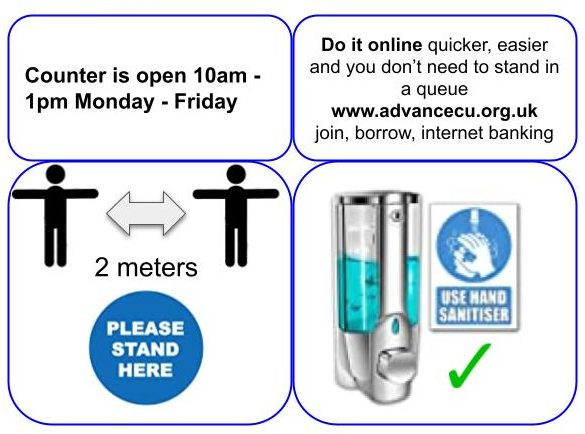

Our customer counter is open from 10am -1pm Monday to Friday for new Members and those who are unable to use internet banking. If you are an existing Member do please use internet banking if possible so we can keep the counter free for new Members and those unable to use internet banking.

Some of our customers may be vulnerable and anxious about restrictions being lifted. To keep our staff and customers as safe as possible please respect our Covid-19 guidelines:

- 2m distancing in our customer area

- Customers must use the hand sanitiser provided at the counter

You are welcome to use our free WiFi and leaflets are now mounted in the outside lobby area, so no need to wait in the queue unless you really need to.

If you need some help to set up and use internet banking, just ask or see our helpful video

COVID-19 HELP AND SUPPORT

You may have concerns about how the Coronavirus/Covid-19 situation could affect you and your money. See this page for the resources available at this time.

Advance Credit Union is ‘business as usual’; your money is safe and share withdrawals, deposits, loan applications are continuing as normal, but the customer counter is closed for the time being. If you aren’t a Member with us you can apply for a loan online or join online.

Our phones are unchanged; 10am-3pm Monday, Tuesday, Thursday and Friday, 10am-12noon Wednesdays.

There are a few things we can all do to keep everyone safe:

- Wash your hands regularly – see NHS guidance how to

- Avoid touching your face – see this BBC article to understand why

- Stay at home – see government guidance

- Do not come to our office . There are better ways to contact us; online chat, internet banking and email.

- Our phones are very busy at the moment, if you can avoid phoning us that would help free up our phone line for those who really need it. Internet banking, Online chat and email are quicker, easier and helps us to deal with more Members.

- Use our internet banking for share withdrawals; it’s quick and easy.

- 80% of our Members already use our internet banking, if you need some help setting this up please see the instructions here, watch our video or send us a message and we’ll talk you through it.

- If you think that you may be struggling with loan repayments due to the Coronavirus situation then please let us know. We will be as helpful as we can.

- If you’re worried about your financial situation because of Coronavirus, please contact us and we will do what we can to help.

- There is support available, see the government website, contact your council, social housing provider or agency.

Work not Worry – financial wellbeing for employees

Would you prefer to save and repay your credit union loan through your payslip? Ask your employer to contact us about Payroll Deduction.

Would you prefer to save and repay your credit union loan through your payslip? Ask your employer to contact us about Payroll Deduction.

We are looking for more employers to partner with us by offering Payroll Deduction as an employee benefit.

AdvanceCU’s financial wellbeing package for employees is a simple but very effective way for employees to access affordable and ethical finance and easily save regularly – straight from their payslip and no cost to the employer.

Find out more