About Internet Banking

If you haven’t yet used our internet banking you will need to activate your account by verifying your email or mobile phone number. See the step by step guide or watch our helpful video if you need some help. Then you can access your credit union accounts with internet banking.

Internet bankingInternet Banking puts you in charge. It is easy to register and it is free. You can access your account 24/7 and keep track of your money.

Benefits of Internet Banking:

- Simple login

- Access your account 24/7 and keep track of your money.

- More secure with 2-step verification

- Two way messaging

- Simple loan applications

- Open Banking or upload to share bank details

- Easy to update your contact details

We will be adding more features, see our roadmap.

Most of our Members use their mobile phone or tablet for internet banking, click here to find out more about Mobile Banking. Smartphone App is coming soon.

There can be a delay of up to 20 minutes in updating transactions on your account, if a recent item isn’t showing then try later.

Engage Account

Do you have an Engage Account? You can also manage your Engage Account online!

Click here to register your card. You will need the activation code sent to you by SMS text message or email when first issued with your card.

Download the Mobile App at the Apple App store or Android Play Store, search for Engage Card by Contis.

How to Register

You will need to activate your internet banking by verifying your email or mobile phone number before accessing your account. This is a fraud prevention measure to help ensure that your account can only be accessed by you. See this step by step guide if you need some help or watch this video

You will need to create your own password – use a unique password not used on any other login and this MUST be only known to you. Do not share your password with anyone.

Your password must be:

- a minimum of 8 characters long

- must include at least:

- 1 capital letter

- 1 lowercase letter

- 1 number

- Special characters are accepted.

If you don’t receive a verification code by email or SMS text message then contact us to update your contact details.

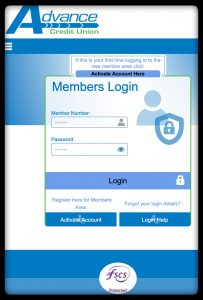

Log on to your account

Follow the instructions below for simple steps to log on to your Advance Credit Union account online.

• Step 1 – Follow the link to AdvanceCU Internet Banking. You may want to save this in your bookmarks or favourites

• Step 2– Membership Number

Please have your Advance CU Membership Number to hand; this will be on your membership book, statement or Welcome letter. Can’t find your Membership Number?

• Step 3 – Password

This is the password you created when you activated your Internet Banking. Forgotten your password?

• Step 4 – Login

Click the ‘Login’ button

• Step 5 – Failed login

Did you activate internet banking?

• Step 6 – Forgotten your password or Membership Number?

• Step 7 – Click here to continue

Your name will be on screen ‘you are logged in’.

Check that the date and time that you last logged in are correct. Contact us or phone 0121 350 8883 if you think that your account has been compromised.

The Options listed are:

- Dashboard

- My Profile – check and update your contact details

- My Accounts – view transactions and balances, share withdrawal

- apply for loan

Use the My Inbox to send us a secure message.

Benefits of Internet Banking

Not yet registered for Internet Banking? Register here

Faster, more convenient

Access your money 24/7

Manage your money on the move with Mobile Banking

Manage your Account

Check your balance

View transactions

Send us a secure online enquiry

Apply for a Loan

Complete your loan application online

Apply for a Share Withdrawal

Complete your share withdrawal application online

There can be a delay of up to an hour in updating transactions on your account, if a recent item isn’t showing then leave it an hour then try checking again.

Mobile Banking

Mobile Banking offers quick and easy banking from your mobile phone or tablet. Manage your money on the move.

If you have already activated AdvanceCU Internet Banking, you can use your mobile device straight away – just login with your usual internet banking details.

You can use your Android smartphone, iPhone, iPad or tablet.

Features of Mobile Banking

Features of Mobile Banking

• Get started right away – just use your existing Internet Banking details to log on.

• no downloads or apps required.

• Check balances & manage your account on the move.

• Apply for share withdrawals

• We use the latest security measures to protect your money and your privacy.

Mobile Banking FAQ

Here are some answers to common questions you might have:

• Is there a mobile banking app?

No, but you can save the login page to your homescreen. Smartphone App is coming soon.

• Can I apply for a loan using mobile banking?

Loan applications can be made from any device using our loan application form. There is also a loan application when you login to internet banking.

• How do I know that Mobile Banking is secure?

We use the latest online security measures to help protect your money, your personal information and your privacy while banking online with us.

You can check what software your phone provider offers to protect you from online viruses and other hazards. Make sure that Bluetooth is switched off when not in use, and don’t accept or open any applications or MMS messages from unknown senders.

Use your mobile security features (such as creating a PIN) and treat the security of your mobile as you would with a personal computer.

• What if I lose my mobile? Is there a risk someone could commit fraud on my account?

To use Mobile Banking, you need to log on using your Member number and password. No one will be able to access your account without this information. Share withdrawals can only be made to your linked and verified bank account or Engage Account.

We would advise you not to store this information on your mobile or anywhere else.

• What happens if I can’t log on to my account?

If you get a Service Unavailable error then we recommend you try again later. Occasionally, we need to make changes to the service which may require a temporary interruption in the service.

If you get a Network Unavailable error then we recommend that you try again later. It probably means that you are out of network coverage.

If you get a Network Timeout then we recommend that you try again. Network timeouts can be caused by a number of things, such as:

• high usage of the mobile network

• poor signal strength

• certain older phones with a slower version of GPRS

• How can I safely recycle or dispose of my mobile phone/device if I have used it for Mobile Banking?

Before disposing of your mobile phone/device, we recommend you restore it to its factory settings. Then you can safely dispose of it. If you’re not sure, please speak to your handset/device provider who should be able to assist you

• Can I use Mobile Banking abroad?

Yes, although it may be unlawful to access some of the services in some countries and you are responsible for your use of it abroad. Your mobile operator may charge you for using Mobile Banking abroad, and roaming charges may apply, so please check with them.

• What should I do if I suspect my security credentials have been compromised?

You should call us immediately on 0121 350 8883 or email info@advancecu.org.uk

Online Security

What we do

We take online Security very seriously and have a number of systems and procedures in place to keep your money safe:

- Secure Log on (look for the green padlock in the address bar)

- You will always have to enter the PIN and password known only to you to access your account online.

- Your connection to Internet Banking is encrypted

- We monitor your account for unusual behaviour

- We will never send you an email asking you to reconfirm your security details and we will never contact you to divulge your full passwords via email, telephone or text message

What you can do

There are simple solutions you can put in place to keep you and your information safe online:

- Creating a strong password

- Do not reveal your Password to anyone

- Check your credit union balances regularly for any unauthorised transactions

- Do not share your mobile device with others and keep PIN or passwords private

- Ensure that only your own fingerprint/face or eye scans are used for biometric login

- Use anti-virus software

- Prevent spam

- Secure your wireless connection

- Learn more about internet security – see the useful links below

- Keep your operating system up to date

- Staying safe on social networking sites

- Guarding against email scams

- Checking website security

If you think that your Internet Banking security credentials have been compromised you should call us immediately on 0121 350 8883 or email info@advancecu.org.uk

Useful Links