Help and Advice

Money Resources

We want to help you manage your money better. Where does your money go each month? Can you reduce the cost of your household bills? How much can you afford to save regularly with Advance Credit Union?

Have you seen our Life Events series? Our top tips for saving money for the big events in life including having a baby, getting married, Christmas, tips for parents and more. We also include free planners to help you make the most of your money.

We encourage all our members to complete a budget, regardless of income. It is important for all of us to know that we are living within our means. In fact a simple budget is required as part of your loan application with Advance; to ensure that member’s don’t borrow more than they can afford. Need some help learning how to manage your money? A CAP Money course could help, find a course near to you.

Why not try the budget planner, courtesy of the Government Money Helper website – you might be surprised by what you find! The planner allows you to save your budget, change it as your circumstances change, plus get guidance on how to manage your money. You can even download your own budget, and use it as part of your Advance Credit Union loan application.

If you prefer a spreadsheet to analyse your budget in more detail, then try the budget analyser on Martin Lewis’ MoneysavingExpert website.

Financial Difficulties

Missed Payments help. If you know that you’ve missed a loan repayment or are likely to then contact our Members Support as soon as possible – we will do what we can to help. Please contact us at the earliest opportunity. We do want to work with you to manage your loan arrears. Most of our members who do fall behind with their payments are able to come to an arrangement with Advance Credit Union, and are able to have another loan in the future without their arrears adversely affecting their credit rating.

Advance Credit Union does not offer personal financial advice, however there are many local agencies who are able to help. Birmingham Advice Services website is a good place to start. If you live in Solihull Borough visit Solihull Here2Help. Also see Helpful links for some contact details.

Advance Credit Union does not offer personal financial advice, however there are many local agencies who are able to help. Birmingham Advice Services website is a good place to start. If you live in Solihull Borough visit Solihull Here2Help. Also see Helpful links for some contact details.

Complaints

Advance Credit Union is committed to providing members with quality financial services. We can only do this with your help. If we have let you down, please tell us. Read more about our Complaints policy and procedure.

Please remember to talk to the Credit Union first if you are unhappy with our services, but don’t forget to tell your friends and family if you have had a great experience with Advance Credit Union!

Important information about compensation arrangements

Savings with Advance Credit Union are covered by the Financial Services Compensation Scheme (FSCS). Read more about the scheme.

Engage Account

The Engage Visa Debit account is purpose-built for credit unions and offers an excellent range of features including cashback rewards of between 3% and 15% on everyday shopping, clothing and electrical items at supermarkets and local stores including ASDA, Argos, B&Q, Halfords, M&S and many more! Other benefits include:

The Engage Visa Debit account is purpose-built for credit unions and offers an excellent range of features including cashback rewards of between 3% and 15% on everyday shopping, clothing and electrical items at supermarkets and local stores including ASDA, Argos, B&Q, Halfords, M&S and many more! Other benefits include:

- FREE to load

- Visa debit card to make purchases in store or online

- No charge for cashback at the till

- Withdraw money via ATMs (75p charge applies)

- UK sort code/ account number

- Contactless capable

- Envelopes for Bill payments

- Android and iPhone smartphone App so you can manage your money from anywhere…anytime

- Online account facility for statements, bill payments, money transfers, etc.

- Standing orders are FREE to set up

- FREE email alerts to help you track your spend

- Exclusive discounts on utilities, phone contracts and broadband

- Telephone and online UK based customer services available 6 days a week

All this for a monthly fee of just £2! Cash rewards from your everyday shopping will offset this cost and there is no charge to load money onto your card.

More and more participating retailers are joining Cashback Rewards – you could receive up to 15% every time you use your Engage Visa debit card to pay for goods instore or online. Participating Retailers include:

About Prepaid cards

Engage Account is a Prepaid card; a pay-as-you-go payment card. Cardholders ‘load’ money onto the card, which can then be used to buy goods and services, or withdraw from cash machines, in the same way as debit cards.

Benefits

- Simple to use

- Safe alternative to carrying cash

- Great way to shop online

- Accepted anywhere in the world – just look for the Visa symbol

- Great budgeting tool

- Low cost

- Check your balance and recent transactions online, text message or by phone

- No overdraft facility, so you can’t spend more than the amount on the card

- No credit checks

- Google Pay and Samsung Pay compatible – pay contactless with your mobile phone

New! Smartcash Junior Account now available for children aged 8-16 years, find out more.

New! Smartcash Junior Account now available for children aged 8-16 years, find out more.

Find out more at the Engage website www.engageaccount.com

Engage prepaid Visa debit cards are issued by Contis Financial Services Ltd. Full terms and conditions including fees and charges www.engageaccount.com/terms-conditions

Download the Mobile App at the Apple App store or Android Play Store, search for Engage Card by Contis.

Bill Payment Service

Take control of household finances with one regular monthly or weekly payment into your credit union account.

We will help you draw up an annual budget to include as many household bills as you wish. Your bills could include gas, electric, water, TV licence, Mortgage, rent, telephone, mobile, TV licence, satellite, cable, broadband, car tax, insurances, loans

We can also handle your savings and loan repayments.

The Bill Payment Service offers complete peace of mind and excellent value for money at a cost of just £1.00 per week. There are no percentage tariff or additional charges.

Payroll Deductions

Advance Credit Union is an Employer-friendly credit union. We will do what we can to make Payroll Deduction as simple as possible for the employer and for employees.

Offering Payroll Deduction with Advance Credit Union as an employee benefit works for you as the employer, and is a valuable service for your employees. Your employees decide how much to save, this is deducted from their pay packet and credited to their Credit Union savings. Find out more about Payroll Deduction and our other services for businesses.

If you would like to offer Payroll Saving to your employees as an Employee Benefit then contact us for further information, or if you would like to arrange a presentation to your board, HR department, payroll department or staff.

Why not forward this page to your HR Manager and we will help enable this facility for yourself and your colleagues.

Tenant Saver Account

Rent paid by housing benefit or universal credit?

Need to be certain the rent is paid on time?

Then Advance Credit Union’s Tenant Saver Account could be for you. Available to tenants of private landlords, housing associations and managing agents with properties within Advance Credit Union’s catchment area of North Birmingham and Solihull Borough.

How does it work?

- The tenant opens a credit union account and agrees with their landlord for the housing benefit or Universal Credit to be paid to AdvanceCU.

- We ‘ringfence’ the housing benefit to ensure the rent is paid. Tenants do not have access to this money.

- We forward the housing benefit to the landlord on a monthly basis with a schedule of payments.

- A £5 fee per tenant per month is deducted, this is paid by the landlord and cannot be passed on to the tenant. This fee is a tax-deductible expense to the landlord and offers exceptional value for money for reducing the risk of rent arrears and potential eviction costs.

- The balance of the tenant’s universal credit or other benefits is their choice – we encourage everyone to save £3 weekly with us; a handy nestegg for a rainy day. More than 1,000 of our members have an Engage Account – the easy way to manage spending using the smartphone App, Contactless debitcard and cashback on spending.

Our Tenant Saver Account offers peace of mind to landlords and security for tenants through managing the local housing allowance on behalf of tenants for the landlords. What’s more, tenants can access our range of services, helping them manage their money better.

Since 2015 we have also accepted Universal Credit for extra peace of mind for landlords and tenants. The housing benefit component is managed in the same way as LHA plus the tenant gains the benefits of credit union membership to manage their money. Find out more about Universal Credit with Advance CU.

Benefits for the Landlord

- Assurance that rent will be received regularly in full and on time

- Payment transferred directly into account

- Avoid eviction and court costs

- Reassurance that tenants have access to affordable and ethical money management services

Benefits for the Tenant

- Security knowing that rent is paid

- Less stress around money management

- Reduce possibility of going into arrears

- Reduce the risk of homelessness

- Ease procedure in finding accommodation

- Promote financial stability

- Easy access to credit union products and services

Benefits for our Community

- Reduce homelessness

- Promotes sustainable tenancies

- Financial stability in the community

- Promote financial inclusion for all

- Support a co-operative organisation

- Support housing supply and demand across the county

Advance Credit Union has extended their Tenant Saver Account to Solihull landlords.

Please find below links to download our information leaflet detailing everything you need to know about the Tenant Saver Account and the application form needed to apply:

Tenant Saver Account Information Leaflet

Tenant Saver Account Information Leaflet

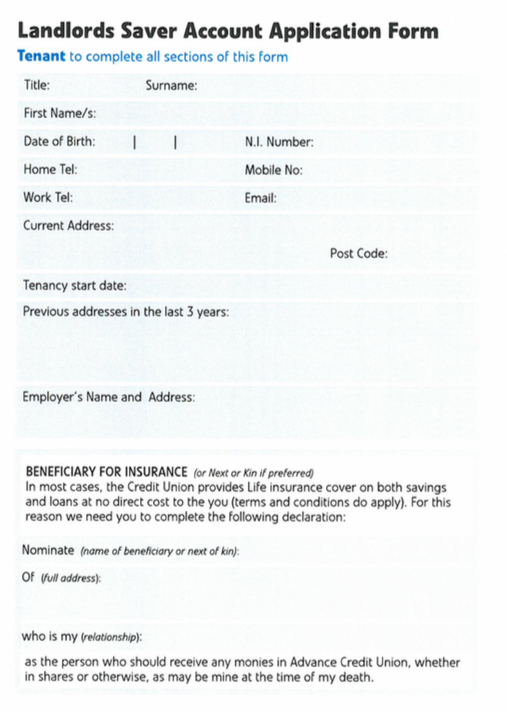

Tenant Saver Account Application Form

Tenant Saver Account Application Form

If you wish to contact us regarding the Tenant Saver Account, or return completed application forms to us, you can call us on 0121 350 8883 or email us at info@advancecu.org.uk. Full contact details can be found at the bottom of this page.

BUDGET PLANNER

This is the best way to be sure you’re in control of your household spending. You will need your income details plus knowing how much you spend on household bills and other spending.

The next stage is to track how much you really spend. A small notebook will do the job, or there are many smartphone Apps that make this a bit easier. Have a look at Android and Apple apps.

Life Insurance

Saving for the future and taking out a loan can involve a long-term financial commitment. We have no way of knowing what unexpected challenges life may spring upon us. Advance Credit Union provides free Loan Protection Insurance and Life Savings Insurance as a benefit to Credit Union members.

Life Savings Protection

Saving with Advance Credit Union really does add up. Not only are your savings secure, but they also include free life assurance cover, which can be a real financial comfort to your loved ones should you die.

Life assurance is a free benefit of saving with your Credit Union, paying your nominated beneficiary an amount equal to the amount of the deceased’s savings. The more you save, the more your loved ones can benefit.

If you deposit money with us between the ages of 16 and 64 years then life insurance benefits of your savings balance up to a maximum of £5,000 will be paid out.

Deposits made between the ages of 65 and 79 benefit from life insurance of 25% of up to £5,000 of your savings.

Members do not qualify for insurance on savings deposited on or after their 80th birthday.

| 16-64 years | 65-79 years | |

| Savings | 100% up to £5,000 | 25% of up to £5,000 deposits |

When you join Advance Credit Union you will be asked to state your chosen ‘Beneficiary for Insurance’. This is usually your next of kin; partner, parent or your child. This is the person who will benefit from any life insurance payable upon your death. Your Beneficiary doesn’t have to be a member of Advance Credit Union, but you may wish to recommend that they join and enjoy the benefits of belonging too.

It is important that you keep your Beneficiary details up to date as your circumstances change, please inform us of any change to your Beneficiary so that your wishes can be respected.

Loan Protection Insurance

If you should take out a loan with Advance Credit Union and die before it is fully repaid, Loan Protection cover can help to ensure your debt is settled and is not passed on to your loved ones when you are no longer here. Loan Protection will make a payment to cover any outstanding amount of loan direct to your Credit Union.

Loan Protection Insurance is provided by Advance Credit Union for you, the member, at no additional cost. If you are under the age of 70 your loan is automatically insured by Advance Credit Union. You will be asked to complete a declaration of health when taking out the loan (some exemptions to the insurance do apply, please ask for more information when applying for your loan). Loan applicants aged 70 or over will not be able to borrow in excess of their savings balance.

Loan Protection insurance will leave you with peace of mind and protection. This means that you can borrow from Advance Credit Union in full confidence that your dependents will not be obliged to repay the outstanding loan balance.

Credit Union borrowers aged between 18 and 69 years benefit from life insurance equal to their loan balance up to a maximum of £5,000.

| 18-69years | 70 years | |

| Loans | 100% up to £5,000 | No cover |

Insurance cover is subject to Terms and Conditions which may apply. You should enquire when making a loan application to see if you are eligible.

Insurance services are arranged by CMutual Group  .

.

Universal Credit

Universal Credit is a single payment made to the household monthly in arrears for working-age benefits being received; housing benefit, JSA, ESA, income support and tax credits. Universal Credit (UC) will start to affect residents of Birmingham from 13th April 2015 and Solihull Borough from 18th May 2015. In order to receive UC you must have either a bank account or credit union account. You will need to provide your credit union membership number as your reference so we recommend that you open an account with us before applying for UC.

Universal Credit is a single payment made to the household monthly in arrears for working-age benefits being received; housing benefit, JSA, ESA, income support and tax credits. Universal Credit (UC) will start to affect residents of Birmingham from 13th April 2015 and Solihull Borough from 18th May 2015. In order to receive UC you must have either a bank account or credit union account. You will need to provide your credit union membership number as your reference so we recommend that you open an account with us before applying for UC.

AdvanceCU already helps more than 2,000 of our members manage their benefits, here’s how we can help you manage your Universal Credit:

Pay the rent – be sure the rent gets paid whether a private landlord or housing association

Engage Visa Account – balance of benefits paid onto a prepaid Visa Debit card; pay at the till, cash from ATM, can’t go overdrawn.

Bill Payments – make sure your essential bills get paid

Affordable Loans – subject to affordability

Regular Savings – build up a financial safety net

Christmas Club – 25th December every year – a little saved regularly reduces the Christmas stress

Internet banking – manage your money 24/7

Join online, at our Erdington office or one of our Community Collection Points.

Resources

Need help with your Universal Credit? Citizens Advice provide a free service help to claim.

Need help with your Universal Credit? Citizens Advice provide a free service help to claim.

Guidance for JobCentrePlus and advisors.

Find out more about Universal Credit at Money Advice Service and how it could affect you.

Birmingham Council webpages on Universal Credit

Solihull Council has information on the Welfare Changes and provides Support to Success.

How Advance Credit Union can help private landlords and Housing Associations

Your Credit History

What is a credit rating?

Credit ratings are used by lenders including Advance Credit Union to calculate how likely you are to repay your loan. Your credit rating is based on a number of different factors including your previous dealings and financial habits. Lenders use credit ratings and credit scores to decide whether to lend you money and, if so, how much.

There are three main credit reference agencies in the UK, these are:

They assess your ‘creditworthiness’ by looking at factors such as your:

- history of borrowing and repayment

- financial assets and liabilities

- electoral roll information

- any County Court Judgments (CCJs) you have against you

- Lenders do interpret your credit worthiness differently so you may be accepted by AdvanceCU even if rejected by another lender.

- However applying to multiple lenders at the same time is likely to be considered a negative feature and may impact your rating.

Why are credit ratings important?

Lenders use your credit rating to work out whether to lend you money. This can also include landline and mobile phone providers, utility firms, landlords – they will also want to be reassured that you will be pay. If your credit rating isn’t so good then you may be charged more interest or on less favourable terms.

Credit Reference Agencies can hold a lot of important information about you. Find out more about how they use and share your personal data CRAINS

How to boost your credit rating without being in debt

Your credit score doesn’t start at zero and you’d don’t need to be in debt to have a credit rating. There are a few things you can do to boost the positive features on your credit history that demonstrate you are a stable and reliable member of society:

- Register on the electoral roll. This will help confirm you identity, it is free and allows you to vote in national and local elections. www.gov.uk/register-to-vote

- Stay at one address. Lenders like stability, so living at one address is regarded favourably.

- Pay your rent and bills on time. Most housing associations, utilities firms, mobile phone contracts and mail order catalogues will share repayment history with credit reference agencies.

- Live with someone with a good credit rating – associated people can affect your own credit rating.

- Use a landline phone number on applications rather than your mobile – demonstrates your stability

- Check your credit report for errors – if a cleared debt is still showing outstanding, or applications you never made. You can contact the credit report agency to correct these

- Financial associates – ex-partner, family members – if you are no longer at the same address or linked financially with a person you can correct these by contacting the credit report agency.

How to check your credit rating for free

Wouldn’t you like to know what lenders know about you? You can obtain your Statutory Credit Report for a small £2 fee from the three credit rating agencies. They do offer a paid-for service however you can now also subscribe to all three credit rating agency reports at no cost. TransUnion/Callcredit offer a free service called Ncredit karma, ClearScore offer free Equifax credit score and reports. Experian creditscores are now also free by signing up to their CreditMatcher service or by subscribing to MoneySavingExpert’s CreditClub.

It is a good idea to check your credit report carefully; there may be mistakes which could be affecting your credit rating. You are entitled to request mistakes to be corrected by writing to your lender.

The credit rating agencies are:

| Free credit reports: | |

|

credit karma TransUnion credit report & score Free For Life |

|

Your Equifax credit report & score free from ClearScore |

|

CreditMatcher free Experian credit score |

|

moneysavingexpert.com/creditclub |

How to improve your credit rating

If you know your credit history isn’t strong then there are things you can do to improve your credit score:

- Register on the electoral roll. This will help confirm you identity, it is free and allows you to vote in national and local elections. www.gov.uk/register-to-vote

- Close any unused credit cards – too much credit will deter other lenders.

- Spread out applications for credit over a period of time; don’t apply to multiple firms within a few weeks.

- Use your landline number on application forms – demonstrates you are at a settled address.

- Avoid a County Court Judgement (CCJ), this will stay on your file for 6 years.

- Avoid high-cost lenders – these are a poor feature to lenders.

How Advance Credit Union can help

Build your credit history. We share our member’s loan payment data with credit reference agencies, this is great news for the more than 2,200 members who repay their loans with us on time every month. Their good repayment history with AdvanceCU will boost their credit rating.

Missed Payments help. If you know that you’ve missed a loan repayment or are likely to then contact us as soon as possible – we will do what we can to help.

Credit-Builder loan. We may be able to offer you an affordable loan to help you build up a good credit history. This will be a small, affordable loan over a short period of time so you can prove your ability to manage credit.