Why credit union

Advance Credit Union is a proud member of the Greater Birmingham Chamber of Commerce. We have been providing simple savings and affordable loans for more than 30 years to the people of Birmingham and Solihull. Find out more about us. We are really pleased to extend our services to Chamber members and the business community. For free. We do not charge our business partners.

Advance Credit Union is a proud member of the Greater Birmingham Chamber of Commerce. We have been providing simple savings and affordable loans for more than 30 years to the people of Birmingham and Solihull. Find out more about us. We are really pleased to extend our services to Chamber members and the business community. For free. We do not charge our business partners.

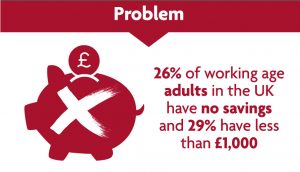

26% of UK adults have little or no savings. This means that when an unexpected bill arrives or a family crisis occurs some households have to borrow, sometimes from high cost lenders. That could include your employees.

Personal debt can cause anxiety and depression, when staff are preoccupied by money worries they are not focusing on their work and performance can suffer.

Credit unions are all about enabling people to manage their money well, save regularly, feel in control of their finances and when they need to borrow then they have access to our affordable, ethical loans. Working with your Advance Credit Union will help your employees and can benefit you as the employer too.

Working in partnership with Advance Credit Union employers can promote good financial health for employees.

Be a credit union Partner

What if you could help your employees with little effort and no cost to your business?

There are three steps you can take It is easy to promote credit union savings and loans to your employees.

- Just download a poster or provide a link to our website on payslips or internal communications. That’s all. We will arrange an account directly with anyone who contacts us.

- Want to do a little bit more? We can provide further marketing materials, articles for staff newsletters, run a presentation to employees or run a ‘join credit union’ event. Just let us know what works best within your company.

- How about making it really simple for staff to save and borrow? Offer credit union savings and loans as an employee benefit. We can setup a Payroll deduction arrangement with you – the simplest way to enable staff to save and borrow. We do not charge employers for this service. Employees are charge our standard £2 annual Membership fee plus any loan interest if they take a loan with us.

Contact us for more information business@advancecu.org.uk or call 0121 663 6390

Payroll Deduction

Offering Payroll Deduction with Advance Credit Union as an employee benefit works for you as the employer, and is a valuable service for your employees. Your employees decide how much to save, this is deducted from their pay packet and credited to their Credit Union savings.

Employees also have access to our affordable loans. Payroll deductions are adjusted to repay the loan from their payslip. Employees’ individual savings and loans are kept confidential and are not disclosed to the employer. We can however provide management information to monitor the take-up and effectiveness of the scheme.

Employers offering payroll saving to their employees have the reassurance that their people are taking responsibility for their money; they are putting some money aside for when they need it, and they have access to the affordable loans from Advance Credit Union.

We do not charge employers for this service and many payroll outsourcers do not charge their customers for the processing of credit union loan repayments, so the cost to employers of offering Payroll Deduction is negligible. takes Boosting staff financial capability is not only good for employee wellbeing, it is also good for your business and a feature of your Corporate Social Responsibility (CSR).

Contact us for more information business@advancecu.org.uk or call 0121 663 6390

Benefits for employers

- Reduce employees’ financial stress

- Reduce salary advance and loan requests

- Reduce absenteeism and presenteeism

- Reassurance that employees have access to affordable finance

- Employees taking responsibility for managing their own money

- Improve employee financial wellbeing

- Corporate Social Responsibility

- Support local social enterprise

Benefits for employees

- Saving straight from their pay packet – they won’t miss it

- Putting some money away for a ‘rainy day’

- Planning for a big event; Christmas, holidays, weddings

- Earn dividend on savings (1% last year)

- Apply for a credit union loan

- Simple loan repayments straight from their pay packet

- Internet banking 24/7

- Life insurance included (terms and conditions apply)

- Confidential; individual’s savings or loans are not disclosed to the employer

Our Payroll Partners

Advance Credit Union already offers Payroll Deduction for employees of the following organisations:

|

|

|

|

|

Tenant Account

For private landlords and social landlords, our Tenant Saver Account ring-fences and manages local housing allowance and universal credit providing reassurance that the rent is paid. Peace of mind for the landlord and security for tenants. What’s more, tenants can access our range of services, helping them manage their money better. Find out more about our Tenant Saver Account.